Your Complete Guide To Florida’s Workers’ Compensation

Originally posted on https://firstcoastaccidentlawyers.com/your-complete-guide-to-floridas-workers-compensation/

Did you know that in the year 2017, more than 5,147 workers met their death at work? This is an average of 14 people each day or approximately 107 people each week. This is quite a vast number of untimely deaths!

With those statistics in mind, it becomes quite evident that every workplace should be covered under the Florida workers compensation. This coverage is used to compensate for injuries that occur in a work environment. Florida State prides a no-fault system, which means that the insurance will cover you even if the injury occurred as a result of your negligence.

An employee needs to file for the claim if the injury is work-related. This means that if an employee is injured during working hours but not a work-related injury, then they are not liable for compensation.

It gets a bit complicated when it comes to the details of the Act under the Worker’s Compensation Act. This is one of the reasons why you need assistance from an experienced attorney. However, here are the basics of the cover and claim process.

How does it Work?

The first thing to note is that worker’s compensation is only for employees of a firm. No matter your industry or service, every firm in Florida is eligible for this cover. However, employers can only purchase insurance coverage if they have more than four workers.

These employees can either be permanent or temporary workers or even casuals for the firm. The Florida Act covers them all!

However, for office administrators, the rules change. If an administrator or member of the firm owns at least 10% of the business, then they can’t be part of the compensation. Such parties can apply for the election of coverage.

Note that the insurance coverage applies with Florida only. This is because different states have different policies. However, your insurance may stretch to offer an All-State Endorsement for non-monopolistic states. This covers those who travel for business purposes outside Florida.

Just like any insurance cover, the worker’s compensation caters for several things which include;

- Medical bills

- Prescription medications

- Lost wages

- Medical equipment

- Ambulance transportation

- Disability payments

The extent of the benefits offered is reliant on whether the injury caused any disabilities; permanent or partial. Sometimes the employee is slightly injured, and he or she can continue with work. The compensation will be low in such a case.

Benefits offered By the Insurance

Below are the upsides to worker’s compensation coverage:

1. Your boss cannot fire you – Bosses might be tempted to fire you mostly if the injury was out of personal negligence. Don’t worry because Florida’s Act protects employees from such kind of retaliation from employers. In case your employer falsely terminates your job due to the incidence, you can file a lawsuit against them.

2. Total disability benefits – if a work-related injury keeps you away from work for more than 21 days, then you’ll receive two-thirds of your average weekly wages from the insurance. In 2019, the highest amount is $939 per week and a legal minimum of $20 a week.

3. Permanent impairment – Some injuries may cause lasting medical conditions, while others may cause impairment. Six weeks before your temporary disability benefits expire, your doctor will perform a thorough checkup to ensure you have no impairment. In case you do, the doctor will rate your condition and calculate how long you should receive impairment benefits.

4. Permanent total disability – Sometimes, the injury causes permanent disability that means you aren’t fit to work anymore. Once the doctor diagnoses this, you will be eligible for permanent total disability benefits until you’re 75 years old, if you qualify for Social Security benefits. If not, you will receive these benefits for the rest of your life!

Other additional benefits may include, vocational rehabilitation where they pay for training and help you get a new job and death benefits handed to your children, partner or other dependents. Each of these benefits work with specific ratings given in the Act and they vary by State.

Limitations of the Coverage

Florida Worker’s comp has quite several constraints. They include;

1. The insurance company chooses your doctor. However, their doctors’ are qualified for your injury type, hence you don’t need to worry about efficiency in treatment.

2. If you don’t report a work-related accident because you think it’s minor, then get impaired by that injury in the future, you have a high chance of losing your case. Report all cases, no matter how small they seem!

3. Insurance companies try to undervalue your compensation. They are never willing to compensate their clients; therefore, they will do whatever they can to pay you the least amount possible. This is where lawyers come in handy as they appeal to fight for what you deserve.

Prohibitions to the Benefits

Just because the State of Florida requires businesses with more than three employees to purchase worker’s compensation coverage, it doesn’t mean that you’ll automatically get compensation for a work-related accident.

If you intentionally inflict injury on yourself for whatever emotional reasons, or to get compensated, then your case will be invalid! You can only injure yourself accidentally and not intentionally.

Employees should ensure that there are safety tips, warning signs, and so forth to keep each employee safe in the work environment. If you choose to ignore policies and warning signs and end up hurting yourself, you’ll not be compensated.

The other scenario is when you, as the employee, is on drugs and working. If you stagger your drunk self into a sharp object, it will not be considered work-related. Such a case is not considered as an accident thus no compensation will be rewarded.

Statutes of Limitations for the Cover

Statutes of limitations are basic laws put up to limit the duration one can take to file a claim. In the State of Florida, you’re not allowed to report work-related injury more than two years after the incident occurred.

At the same time, it is advisable to file a claim immediately the injury occurs. However, your application may be considered two years later under the following circumstances;

- The injured worker is below 18 years old making them a minor

- If the employer misled the worker regarding the coverage

- The injured employee is mentally incompetent

- The insurance carrier misinformed the employee of their rights

Among the mentioned, it’s important to note that when an employee is injured so much that they require a prosthesis, then at this point, Florida’s statutes of limitations become invalid!

Warning to Employer’s about Florida Worker’s Compensation

As an employer, you’re expected to obtain the worker’s compensationcoverage for your employees. To achieve this, you need to request a quote from the insurance company of your choice.

Failure to obtain the worker’s comp cover for your employees, you’ll be eligible for civil penalties. This mainly means that the state of Florida will lawfully halt your business from operations, or rather offer a stop-work order until you pay the penalty and then comply with the law by getting the coverage.

The penalty is usually twice the amount of premium that you – as the employer – would have paid in the preceding two years. If you fail to comply with the stop-work order, then it will result in criminal charges.

You can also receive a stop-order if you have understated the number of employee wages or concealed them. Another case would be when you decide to obscure or misrepresent your employee’s duties or job description. Finally, if you attempt to avoid paying worker’s compensation to an injured employee, you will receive a stop-order.

Compensation for Pain and Suffering

Unfortunately, Florida worker’s comp doesn’t cover pain and suffering for either the employee or their family. However, you can take up legal action against an involved party to claim for compensation via personal injury law.

How can you achieve this?

When an accident occurs, several parties are involved. There’s you, your employer, and the equipment that caused the accident. A manufacturer represents that equipment.

The idea is, there must have been a manufacturing issue with the equipment for it to act faulty. In such a case, you can sue the manufacturing company!

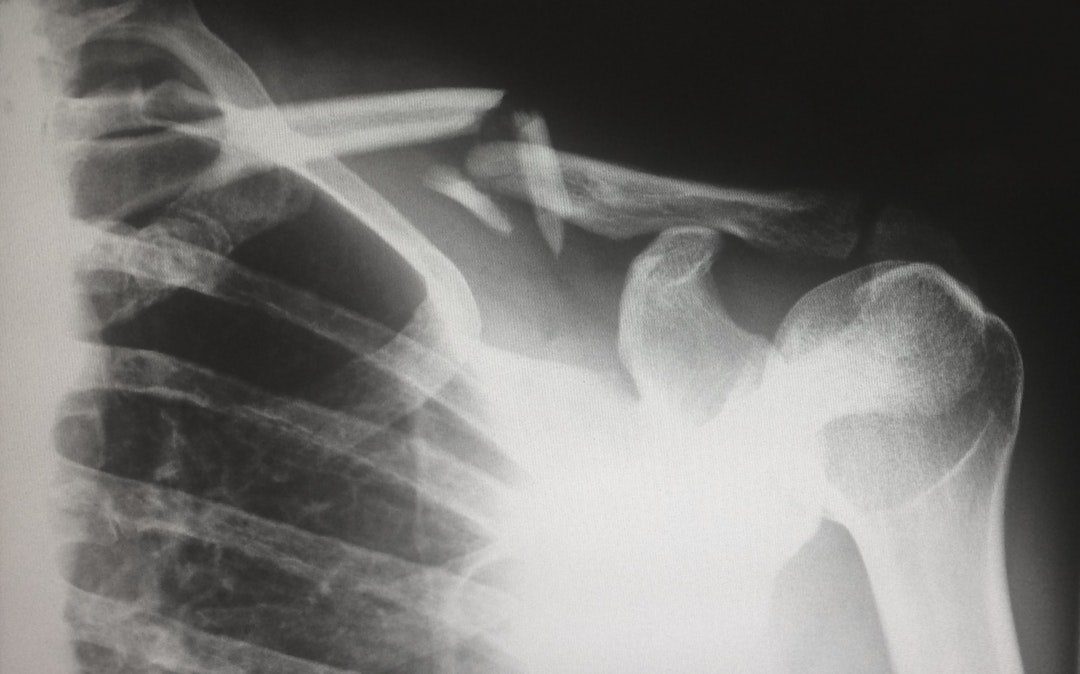

Another scenario would be if an expert came to your workplace and performed some installation. If whatever reason the installation causes an accident, then you can sue them. If the floor is wet and slippery and the janitor hasn’t put up a warning sign, causing you to slip and break your arm, you can sue them for compensation.

Contact a Qualified Attorney Today!

Even if your boss or the insurance explain the policies of the cover, it would be crucial to get a third opinion from a qualified lawyer. Let your lawyer take you through Florida workers compensation and brief you about your rights and how to proceed with a claim.

Your lawyer will also advise you about any lawsuits you can pursue to get more compensation. Are you looking for a worker’s compensation attorney? Contact us today and let us help you recover your losses.