Top 5 Identity Verification Methods

Photo From Getty Images

Originally Posted On: https://www.microbilt.com/news/article/top-5-identity-verification-methods

Identity verification has become an essential component for many of today’s businesses, especially financial institutions and e-commerce companies. Know Your Customer (KYC) and Anti-Money Laundering (AML) rules are driving the development of identity verification techniques throughout the world, although each country has its own regulations and organizations to enforce these rules. For example, the Financial Crimes Enforcement Network (FCEN) is one of the many agencies responsible for regulating identity verification methods in the United States. These techniques generally fall into one of the following five categories.

- Knowledge-based authentication

- Two-factor authentication

- Credit bureau-based authentication

- Database methods

- Online verification

What is Identity Verification?

ID Verification is one step beyond identification, but a step below authentication and is a necessary process that ensures a person’s identity matches the one that’s imagined to be. Identity is a set of unique characteristics and traits related to a singular individual. It becomes essential within the web environment when we mention people and the likelihood of fraud is more common. Identity Verification is required in most online and offline processes and procedures, from completing IRS tax documentation online to opening a checking account.

Photo from Adobe Stock

There are a multitude of ways in which Identity Verification can be performed and today we will focus on five of the most common.

Knowledge-Based Authentication

Knowledge-based authentication (KBA) verifies a person’s identity by requiring an answer to security questions. These questions are generally designed to be easy for that person to answer, but difficult for anyone to answer. Additional safeguards for KBA include a requirement to answer the questions within a specified time limit. The biggest advantage of KBA is that it’s the easiest verification method for users to understand. Its biggest disadvantage is that it’s getting increasingly easy to discover the answers via social networking and other more traditional forms of social engineering.

Two-Factor Authentication

Two-factor authentication generally requires users to provide a form of personal identification, also known as a token, in addition to the usual username and password before they can access an account. The token should be something users have memorized or in their possession such as a code, they have received from the authenticating agency. The need for a token creates a strong deterrence for fraudulent activity. Two-factor authentication is particularly useful for creating accounts and resetting passwords. However, this method typically requires users to have their smartphones with them during the authentication process.

Credit Bureau-Based Authentication

A credit bureau-based authentication method relies on information from one or more of the major credit bureaus. These companies store a large amount of credit information on consumers, including name, address, and social security number. Credit-based authentication uses a score to create a definitive match without compromising the user’s experience. However, it may not be able to match users with thin credit files, such as young people and recent immigrants.

Database Methods

Database ID methods use data from a variety of sources to verify someone’s identity. These sources include online databases from social media as well as offline databases. Database methods are often used to assess the level of risk a user poses since they significantly reduce the need for manual reviews. The biggest disadvantage of these methods is that they don’t ensure that the person providing the information is the person conducting the transaction, largely due to the proliferation of false online identities.

Online Verification

Online verification uses techniques to determine if a government-issued id belongs to the users, including artificial intelligence, biometrics, computer vision and human review. This verification method typically requires users to provide a picture of themselves holding an ID, thus ensuring the person on the ID is the same person holding the ID. Online verification is very secure, but some users find submitting an image of their face and ID to be inconvenient or intrusive.

What are the benefits of adding ID Verification to your process?

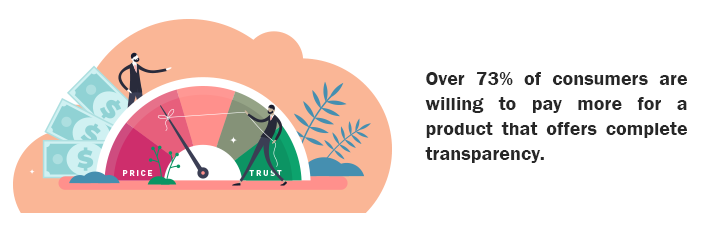

Reputation plays a big role for businesses of all sizes. It’s extremely important to stand out as a trustworthy choice for consumers among the thousands of others. In fact, a Label Insight survey relates that consumers are willing to pay more for a product that offers complete transparency.

Photo from Adobe Stock

In an era of data breaches, consumers want to be certain that their information is kept safe. By running identity verification checks, you signal that you are serious about building trust.

Avoiding costly fines and chargebacks are also a top benefit that you need to be aware of when running a business. Over 90 countries now require businesses to verify the identities of their customers and keep those records for a number of years. Assessing the risk of illegal activities should be one of your priorities since credit card fraud makes up a huge portion of the total number of identity fraud cases every year.

When your business accepts credit card payments, you are at risk for costly chargebacks (the industry standard rate is 1%) due to transactions falling into the “card-not-present” category. Preventing this is simply a case of revising existing protocols for identity verification or implementing some.

MicroBilt offers top of the line solutions for Identity Verification with tools to help you protect your business from fraud and the subsequent impact of identity theft.