Reimagining the Role of Tax Data in Small Business Lending

Photo by Campaign Creators

Originally Posted On: https://tax-guard.com/blog/reimagining-the-role-of-tax-data-in-small-business-lending-due-diligence/

The saying “knowledge is power” is not wasted on credit risk professionals. For the most successful non-bank alternative lenders, the wellspring of knowledge is rooted in their data – but their data efforts are only as valuable as getting the right data to produce the most powerful results.

Currently, there’s a gap in tax data utilization for some alternative finance companies. The clear disconnect between the traditional tax data that lenders are using and what they should be using is creating a divide between the industry followers and the industry innovators.

We’ll draw upon the current landscape of a typical lender’s due diligence data and take a deep dive into our own research to illustrate how we got to this point of disconnect. Then we can answer what credit risk professionals can do to optimize their credit risk models.

For lenders, staying competitive while leveraging all available tools to improve the bottom line is the name of the game.

Non-Bank Alternative Lenders are the Fintech Data Leaders

For non-bank alternative lenders, it’s understandable that they’re constantly trying to balance the elements of risk with the need to fund with speed. These forces driven by the hyper-competitive marketplace have put credit risk professionals in the driver seats to grow their organizations.

As a result, credit risk professionals have been tasked with marrying up their data-driven processes and technologies to sharpen their capabilities to do everything from, quickly identifying fraud to predicting borrower creditworthiness without disrupting their deal flows and increasing risk.

This aspect of data model innovation has been key in allowing non-bank alternative lenders to grow their footprint and lead the way in gaining SMB lending market share over traditional banks. By taking a look at a few of the big names in alternative finance it’s easy to see how these non-bank lenders are using data to underwrite and fund small businesses with speed previously thought to be impossible:

- OnDeck’s propriety score utilizes 2,000 data points

- Kabbage can disburse funds in minutes

- PayPal’s small business loan platform can underwrite and fund in a day

Leveraging Available Data

In order to continue non-bank alternative finance’s positive trend, ALL impactful data must be leveraged to charge forward.

This is where tax data comes into the picture.

One crucial, but obvious assumption of lenders is this – knowledge of whether a business is paying its current debts is indicative of the probability that their loan will be repaid in full or not.

The question then becomes, are all the facets of tax data being used to determine if the business is creditworthy enough to afford the loan? Why? Because if you care if a business is paying its bills, you most definitely care if a borrower is paying their IRS obligations in full and on time.

Sloppy payment history is the very definition of risk to lenders because eventually, it catches up to the borrower.

Current Tax Data In the Market Is Flawed

Let’s start with the current tools used to answer the question of how creditworthy is a borrower. Whether it’s OnDeck’s 2,000 data point model or an Excel spreadsheet with formulas, the online lender’s secret sauce to inform credit decisioning is typically made with a blend of traditional and non-traditional data.

Most commercial lenders that we consult with are relying on some mix of third-party data inputs to build their credit models and depending on sophistication, their own proprietary scores for lending. The following is by no means a comprehensive list, but serves to illustrate the landscape of available data typically used by commercial lenders:

- Credit reports – FICO, payment history, delinquencies, etc.

- Borrower Provided Documents – bank statements, business tax returns, credit card processing statements, etc.

- Public Records – judgments, bankruptcies, personal credit, UCC searches, etc.

- Firmographic Data – Industry type, time in business, location, etc.

- Public Record Tax Data – Recorded IRS tax liens, state tax liens, property tax liens, etc.

Since we’re highlighting the disconnect in tax data, let’s drill down on IRS “Public Record Tax Data”, aka the Federal Tax Lien. A generally accepted truth amongst commercial lenders is that if a business is not paying their taxes a tax lien will show up on a public records search.

Hmmm. Not so fast.

Sometimes generally accepted truths erode until they are no longer truthful, that is until a new truth emerges. Our in-depth research of tax data dispels this commonly accepted myth – giving credit risk professionals a new light on how to use tax data to dramatically improve their credit decisioning.

3 Major Problems With Current Tax Data for Due Diligence

Let’s start with what’s wrong with the current data available –

1. Credit Reports are Unreliable-

The recent decision from the major credit bureaus to no longer include IRS tax lien data on credit reports has illustrated a growing gap in the typical credit risk model of non-bank alternative lenders.

Not only are credit scores predicted to rise 20-40 points, but we have a current landscape where 100% of past, present, and future tax lien data will no longer find its way to a credit report. (For more background on this development, see our blogs, 100% of Tax Liens Have Been Stripped from Credit Reports – Should Lenders Be Alarmed? & Credit Reports are Removing Tax Liens: What Lenders Need to Know)

If you’re relying on credit reports to illuminate borrower risk from IRS tax data, you can throw that report out the window.

2. Tax Liens are Inaccurate-

In the context of any type of secure lending, searching for tax liens is necessary to determine if another party has a lawful claim or right against the borrower’s property or funds.

However, in the context of determining creditworthiness, if IRS tax liens are found by scraping public records, it’s by definition a historical document – a snapshot in time, outdated the very moment it’s recorded.

Meaning, when an IRS lien is filed and recorded there’s a static dollar amount attached to the lien. If the borrower pays it down, the dollar amount on the publically recorded lien actually stays the same. Conversely, if the borrower doesn’t pay anything the penalties and interest rack up from that day forward. A $500,000 lien that is found in the public record could actually be a $1 or $750,000 balance due to the IRS depending on what has transpired since the date of the filing.

Also, (sarcasm alert) believe it or not, the IRS makes mistakes. Sometimes liens are filed erroneously or recorded with the wrong dollar amounts. Other times liens are paid off in full, but still remain on the public record and show up in public record searches.

When speed and accuracy are important, this level of ambiguity makes for an inaccurate variable to inject into any credit model and raises more questions than answers.

So, if you’re relying on a tax lien search to paint an accurate picture of borrower creditworthiness, you can’t trust those findings either.

3. Tax Liens are Not Always Filed When Tax Debt is Assessed –

Ring the alarm! This problem should wake up any and all credit risk professionals.

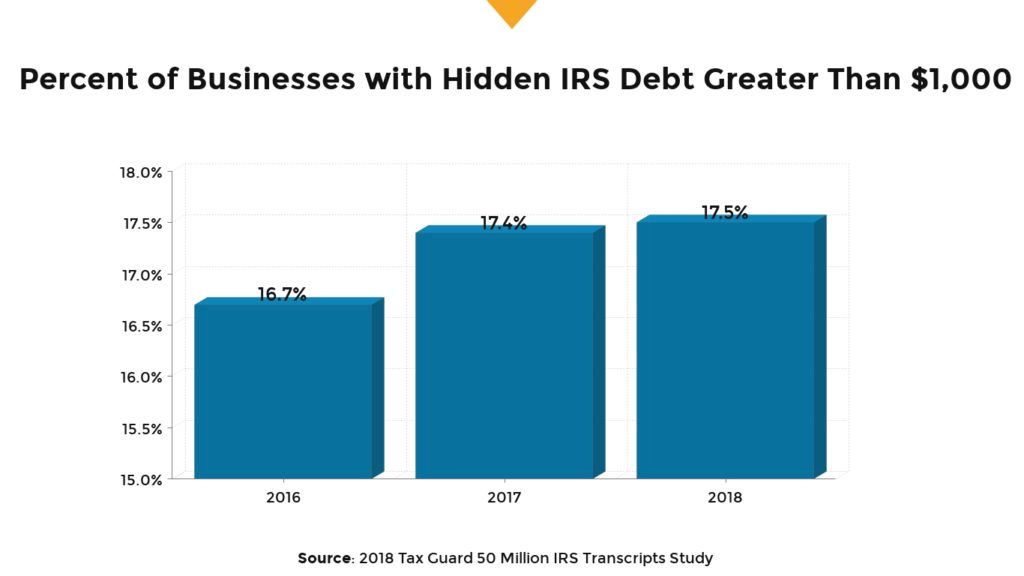

Tax Guard recently conducted a study on over 50 million IRS tax transcript records across 15k attributes. We looked at businesses, consumers, spouses, guarantors, with incomes/revenue from 25k to $1 billion across the spectrum of various industries and were able to confirm:

Nearly 1 in 5 businesses have a tax debt with no IRS tax lien filed.

Let this all sink in.

Nearly 1-in-5 businesses are unable to pay their taxes and you have no idea who they are by running credit report or looking for tax liens in public records. In addition, as you can see from the graph above, it’s a year-over-year increasing trend too.

Unpaid IRS taxes are a leading indicator of, at best, a symptom of a cash flow issue or at worse, business failure or fraud.

Therefore, it’s of paramount importance to understand that credit risk is created when a business fails to pay or file taxes on time, not if and when the IRS arbitrarily decides to file a lien.

Tax Data Reimagined

When armed with the data to dispel preconceived notions and accepted truths, it becomes empowering to use the same data to rewrite the narrative to make even better-informed credit decisions.

Credit risk professionals from across the country and from every type of lending organizations have been coming to us asking, “How do I find these applicants and borrowers with hidden tax debts and what are they hiding? Have they verifiably filed all their tax returns? Are they on a payment plan? Are they making tax deposits?”

To start, the simplest way to determine these answers is to stop using public tax liens as a creditworthiness indicator and start using IRS tax debt as the new data to predict fraud, assess creditworthiness, and determine opportunities for renewals.

In order to accomplish this solution, you must obtain, verify, and digest the tax debt data directly from the source, the IRS. As you can imagine, this is a process that’s rife with the complexities of interacting with the archaic and unpredictable nature of the IRS. Also, managing the overwhelming minutiae and nuances that come along with interpreting tax data for lender’s due diligence requires a level of deep expertise rarely seen outside of the tax expert domain.

Tax Guard’s patent-pending technology and solution is one that we’ve perfected and have counseled thousands of credit risk professionals on over the past 10 years. If you want to discover how to leverage this innovative tax data to identify the 1-in-5 applicants that have a hidden tax debt in your portfolio please reach out for a consultation today.