Is a Prepaid Card Right for Your Teen?

Originally posted on https://mummyfever.co.uk/is-a-prepaid-card-right-for-your-teen/

As parents, you always want to teach your kids financial responsibility. One way to do that is with a prepaid card, but you should make sure that your teen is ready for it.

While it is a good way for them to learn to save, these cards do have their drawbacks. If you use them to properly guide your children with money management, it can not only prove helpful in the short-run, it can be extremely beneficial in the long-run.

It’s one way you can give them the gift of financial independence while lessening your own stress.

WHAT IS A PREPAID CARD?

A prepaid card is just like a bank or credit card, except you load the money on to it and when it runs out it’s gone. You won’t have overdraft fees or problems with your child overspending. Furthermore, according to the website MoneyPug, a platform used to compare prepaid cards, it is possible to find one that is either free to activate or with very low fees.

POSITIVES OF YOUNG PEOPLE HAVING PREPAID CARDS

Prepaid cards can help teens and young adults learn how to manage and save money, it can also give them freedom to make good and bad choices.

We all know that teenagers don’t listen if you control them too much. We remember being like that ourselves at the same age.

They can also use the card online, which is something we cannot avoid in the modern world. Instead of bothering you for your card when they need or want something from a website, they can purchase the item themselves. This is also a good opportunity for teaching them about web safety.

Sometimes it is better for them to learn the hard way. If you load a certain amount of money onto their card and they spend it too quickly, they will learn that they need to be frugal and spend only on things they really want and need.

Believe it or not, prepaid cards are safer than cash. A young person carrying around hard cash is a terrifying thing. They may lose it, or have it get stolen from their backpack or wallet. With a card that is prepaid, you can cancel it right away if it is lost and take out the money that you put onto it in the first place. Not only does it provide safety, it gives parents peace of mind.

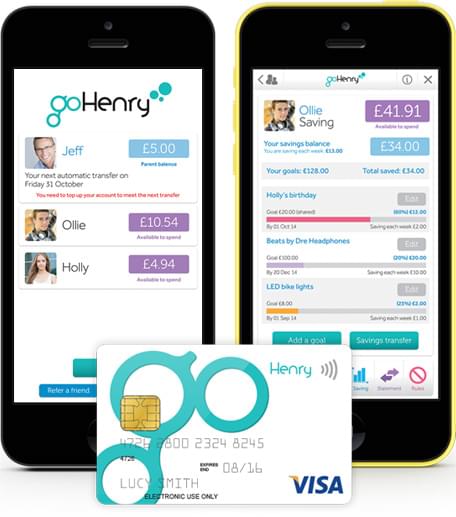

Finally, you get control of how much is put on the card and what they can spend it on. Some cards will even send you constant updates about how much they are spending, what they are spending it on, and where they are purchasing things from. Again, peace of mind is an essential part of allowing your teen to use prepaid cards.

DISADVANTAGES OF PREPAID CARDS

One thing you should know about getting a prepaid card for your teen is that fees can add up. It depends on what provider you’re using of course, but some companies make money from prepaid cards by charging for withdrawals and activation. You should be careful and know what you are getting into.

Finally, if the teen gets too used to prepaid cards it may be difficult for them to transition to the real cutthroat world of credit and bank charges. It is important to keep up on their financial education and show them not only how to save but how to remain as financially intelligent as they can be.

IS IT TIME FOR MY CHILD TO GET A PREPAID CARD?

Though there are some negatives to prepaid cards, it really depends if your child is ready for the responsibility. If you use the opportunity to help them learn, the advantages far out way the disadvantages. Put the time into finding the right card and you will be able to make a convenient choice for you and your young person.