How Will Climate Change Affect the Property Market

Originally posted on https://www.emc2property.co.uk/news/how-will-climate-change-affect-the-property-market

Will climate change affect the property market?

With near daily headlines discussing climate change, it is evidently a hot topic at present and for good reason.

While wildlife, agriculture and weather systems will be immensely affected by climate change, could there also be a direct affect to the property market?

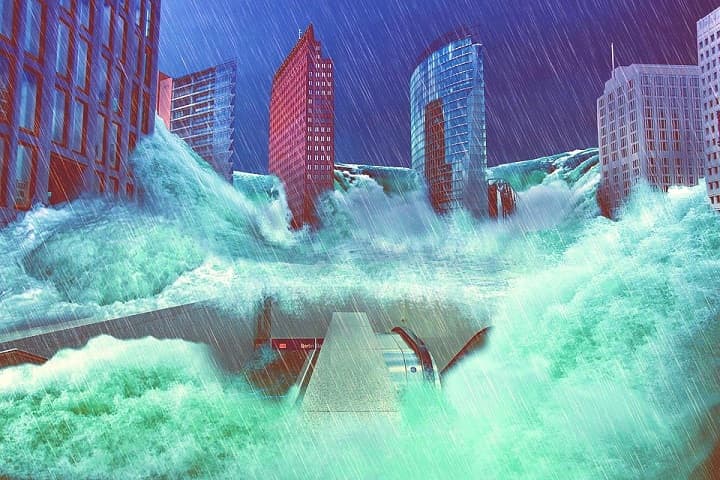

Sea level rise and real estate

One of the greatest threats of climate change to the human population is the rising of sea levels.

If current predictions are accurate, by 2050, 800 million people worldwide will be threatened by a sea level rise of only 0.5m, however recent studies predict that levels could rise by as much as 2m.

Remaining at the current rate of global warming, in the UK alone, 1.5 million properties will be at risk from rising sea levels by 2085.

US states, such as Florida face an even greater challenge. By the year 2070, the streets of Miami will flood on an annual basis and this is not factoring in the effect of flooding caused by hurricanes.

It is not only South Eastern US cities at risk of sea level rise;

Key investment markets such as New York, Boston, San Francisco and Los Angeles along with Osaka, Hong Kong and Shanghai are also highly exposed and house a total of over 44 million people.

Figure depicting percentage of properties exposed to flooding. Source: Four Twenty Seven

Waterfront properties

A coastal property may seem like an ideal investment at present due to a constant high demand and rising prices.

However as the number of millennials entering the market increases, we could potentially see a large shift in spending away from coastal areas, which is in part due to millennials being more active in the climate crisis.

This could have a dramatic effect on property prices. Prestigious low-lying markets such as Miami, New York, Cannes, London and Amsterdam are currently some of the most expensive markets worldwide, however rising sea levels and less interest could cause prices in these areas to plummet.

Along the same lines, as the risk of flooding of waterfront properties increases, insurance premiums will skyrocket, to a point where insurers may not even offer flood insurance; If a homeowner cannot insure their property for flood damage, it is likely they will move.

Extreme weather

In 2017, there was an estimated $220 billion in damages caused by hurricanes Harvey, Irma and Maria alone.

As the rate of global warming increases, extreme weather such as hurricanes and wildfires becomes far more likely and ever more severe.

Areas of the USA which are prone to hurricanes and flooding may have protective measures in place and buildings which can withstand the forces of Mother Nature. However, parts of Asia and other numerous small islands are much more vulnerable to extreme weather at present; a human-caused increase in severity of extreme weather will prove fatal for millions of people, businesses and infrastructure.

In order to mitigate the damaging effects of extreme weather, it is estimated that every $1 dollar invested into protective measures today will save $5 in rectifying damages in future.

Relocating populations

70% of the largest European cities are threatened by rising sea levels.

The cumulative population worldwide which will be affected by rising sea levels and extreme weather will be forced to relocate. It therefore becomes evident that there is a severe looming question as to where these people will relocate to;

If entire cities become uninhabitable, it would be financially impossible to rebuild numerous new cities, let alone with the current time restraints being toward the end of the century – (Sea levels rising at the current and future predicted rate will flood numerous large cities by 2100).

You can view the shocking predictions of sea level rise in numerous cities from a 2 and 4 degrees celsius increase in global temperatures here.

Miami Beach with a global temperature increase of 2 degrees celsius. Image source: Climate Central

Future-proofing buildings and houses

1. Regulations and retrofitting

Considering that a large percentage of properties worldwide are situated in areas at high risk of rising sea levels and detrimental extreme weather, it would seem beneficial for the most at-risk properties to receive preventative retrofitting.

As mentioned earlier, it is five times cheaper to invest in damage prevention than to spend on repairs after a disastrous event.

Retrofitting properties could include flood prevention measures such as raised openings to properties, non-return valves on drainage systems, water resistant coatings on doors and windows among many other measures. Many of these damage prevention measures can be implemented at a fairly low cost.

Cities themselves which are at risk of flooding could also benefit from infrastructure upgrades, similar to how the city of Amsterdam (and the majority of the Netherlands) manages flood mitigation.

The Netherlands has extensive networks of dams, dikes, floodgates, pumping stations, canals and natural sand dunes in order to retain habitable dry land. Without these flood prevention systems, the Netherlands would be largely underwater.

Figure depicting the percentage of the Netherlands underwater if no flood prevention measures were used. Source.

Further, would you agree that new property developments located in high risk areas should have strict damage prevention guidelines, similar to the earthquake building regulations in the state of California?

In many US states, building in wetlands and flood plains is not permitted, however this does not provide damage prevention for coastal properties. Perhaps new builds in high risk areas should be built on raised foundations, so that in the unfortunate and inevitable event of a flood, a fewer number of households will be affected.

2. Green homes

Moving past the effect of extreme weather, as the population advances away from fossil fuels and un-sustainable materials, ideally we should be seeing a considerable shift to the construction of sustainable eco-homes. However at present, these sustainable property development companies are few and far between.

Undoubtedly, the entire global population should promptly deviate away from heavy consumption and reliance on fossil fuels. As the textile and manufacturing industries are altering their processes and materials to strive for a greener planet, so too should the real estate industry.

New buildings can, or should, be constructed from all of the available sustainable materials and fitted with the latest technologies and renewable systems in order to reduce the demand for energy usage.

The transportation sector is gradually moving to all-electric vehicles and not relying on outdated internal combustion engines. In a similar light, the property development sector should also follow suit by focusing on sustainable, eco-home properties as a priority.

You may be thinking that if you’re using solar panels that your home is already green, however there are a wide variety of materials, technologies and systems which are combined to construct sustainable, eco friendly properties.

The ideal future scenario would be that a large percentage of humans were to reside in carbon-neutral, or even carbon-negative eco friendly homes. With the inclusion of renewable energy sources, many locations worldwide would have the ability to become completely self-sufficient.

Hopefully in the years to come we will observe a dramatic shift into advanced eco-home construction as a necessity.

Financial implications

1. Costs

It may be extremely costly to begin damage prevention to the real estate market but it is highly necessary. The preferable route would be to invest in damage prevention rather than lose $billions, or more likely $trillions in real estate worldwide.

Having said that, there has already been a substantial loss of property, without the further warming of the climate. Between 2005 and 2017, there was just shy of $16 billion in property losses, in the USA alone. Further to this, Zillow predicted that if current levels of climate change continue, the state of Florida could find $413 billion worth of property flooded and inhabitable by the year 2100.

2. Investments

You may now be wondering whether to hold onto your waterside property or to sell and invest further inland.

While we have painted a bleak picture of the outcomes of climate change on the property market so far, there are numerous committees which are constructing, and have constructed, plans to mitigate the risks and damage to low-laying properties.

In addition, there is also the likelihood that scientists will discover innovative methods of capturing harmful gasses from the atmosphere, thus reducing the effects of climate change. It is not only the flooding of properties that is of concern – if climate change and carbon emissions are not addressed then other, more serious issues will arise, such as global food shortages.

Therefore, rather than selling a property which is deemed to be situated in a high flood risk area, a more logical approach would be to observe the infrastructural changes and scientific advances that will occur over the coming decade before upping sticks and moving to higher altitude inland properties.

The other view you could take however, is that as more people decide to relocate away from the coast due to the worry of floods, demand for inland properties will increase. You could therefore invest in less sought-after inland locations now to profit from future high demand.

Key takeaway points

- Extreme weather due to climate change has already caused over a trillion $ in damage and claimed thousands of lives, which will worsen over time without intervention

- Waterfront properties are at greatest risk of damage from climate change

- Flooding due to sea levels rising is predicted to affect 800 million people by the year 2050

- The flooding, extreme weather, relocating populations and decreased interest in properties with increasing flood risks could see property prices in key markets decrease

- Sustainable, eco-friendly and extreme weather resistant properties should become much more prominent and the most common property type constructed by developers

- In the state of Florida alone, by 2100, over $400 billion in property could become inhabitable

- High altitude, less sought after locations could possibly become investment hotspots in the next 25+ years

- The property industry is still a long way from improving its contribution to the environment, however developers and industry leaders are beginning to make initial steps to reduce the impact of real estate on climate change

Click here to stay up to date with the latest real estate news and guides from EMC2 Property.