Gaming Apps Cash In, Consumer Spending Hit $100B in 2020

Photo by Taylor R

Originally Posted On: Gaming Apps Cash In, Spend Hits $100B | AdAction.com

2020 was a huge year for gaming apps. They benefited from more user attention, as most of us spent more time at home during the pandemic. These apps cashed in, and consumer spending hit $100 billion, according to data from AppAnnie’s State of Mobile 2021. Let’s dive into the data and discuss ways for gaming apps to take advantage of new trends.

What We Know About Gamers and Their App Usage

The report offers some exceptional insights into gamers and their new behaviors. Next, we’ll break down metrics by game type.

Downloads

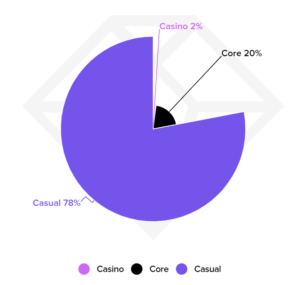

For all of 2020, mobile app downloads of games represented 36% of all downloads. That equates to over 80 billion downloads. Below is the graphic from the report, indicating the most desired gaming category was casual.

Image: AppAnnie

Time Spent

Getting a user to download your app is only the first part of the relationship. Retaining them and engaging them is what leads to opportunities to monetize. Usage did skyrocket, too, with players spending 35% more time on these apps, attributed to lockdowns.

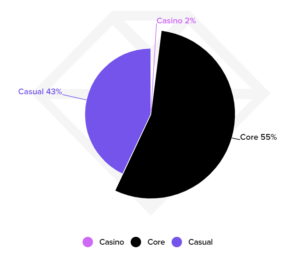

Those spending the most time on gaming apps were core gamers, but casual was close behind.

Image: AppAnnie

The report also drills down into specific categories to discern market share increases from the previous year. Those leading the way were, Arcade>Other Arcade, Hyper Casual>Puzzle/Trivia, and Simulation>Sandbox.

Who Are the Spenders?

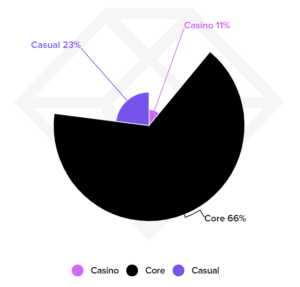

Core gamers are the big spenders, making up 66% of purchases. They are, obviously, the bread and butter for app spending.

Image: AppAnnie

But will their levels of spend and engagement continue? Experts believe there’s no slowdown in sight. They predict mobile gaming apps will generate over $120 billion in 2021.

Events Drive Highest Gaming ARPU Ever

ARPU (average revenue per user) is a key metric for app marketers and publishers. Optimizing it requires engagement. The apps that succeeded here and rose the ARPU by 20% did so with various strategies. Region impacted what those were. In the west, gaming apps achieved monetization through events, leaderboards, and customization.

The APAC region had differences. The features that boosted ARPU in this area included competitive multiplayer, chat, daily and logins, and guilds and clans.

The Breakout Games for 2020

Game developers had unique opportunities in the pandemic to reach new audiences that were almost captive. That changed the player persona in some ways, although core gamers were still the top spenders. Some breakout games included:

Download Leaders

- Among Us

- Brain Test: Tricky Puzzles

- My Talking Tom Friends

- Coin Master

- Save the Girl

- Woodturning

Spend Leaders

- ROBLOX

- Coin Master

- Call of Duty: Mobile

- State of Survival

- Pokémon GO

Time on App Leaders

- ROBLOX

- Free Fire

- Among Us

- Call of Duty: Mobile

- Honour of Kings

- Minecraft Pocket Edition

- Coin Master

- Brawl Stars

Among Us has been one of the hottest games around, with 295 million monthly active users by October 2020. You’ll also notice some traditional console games like Call of Duty and Minecraft growing users for mobile app versions.

Players enjoyed RPG (role-play games), action, casual arcade, casual puzzle, and hyper casual games in 2020. They are likely hooked and will continue to devote time, engagement, and dollars.

What Can Gaming Apps Learn from these Trends?

Looking at the data points above, what are some critical takeaways for the mobile gaming trends?

Engagement leads to more time on the app and spend.

That’s always been true for any app. The best way games can create engagement that’s not disruptive or forced is with offerwalls. They are user-initiated, so they don’t interrupt gameplay. In most cases, games use offerwalls to monetize non-paying players. However, you can also use them to promote IAPs (in-app purchase). They enable you to create an in-app store, where you can sell virtual currency or anything else gamers need to enhance the game.

Core games are the best money makers.

Core games have the biggest opportunity to generate spend. These types of games are by far the leaders in consumer spending. Action and RPG are the most lucrative. Why? These games often require a commitment from the player. They become absorbed in this new world and are swept up in the storytelling.

When you have loyal users like this, they’ll be more apt to make purchases to continue the game. To optimize this, you can develop campaigns that hit users at pivotal moments. For example, if a player needs a special token to reach a level that unlocks new worlds, be sure to promote it at the perfect time.

Game play features grow monetization.

The data from the past year revealed the increase in ARPU and its connection to specific game features, including events, leaderboards, customization, competitive multiplayer, and chat. Does your game have these? If you do, are you optimizing them? Consider how you can enhance your app with these features and what strategies you can leverage to promote them.

Casual games can lift spend, too.

Apps bringing in the most spend were core, but there are opportunities for casual games. In the U.S., Russia, the UK, Germany, France, and India, Gardenscapes – New Acres was in the top 5 of spend. It’s a puzzle game but also has a storyline. Those two things together seem to have intrigued players.

With this success story, there are certainly ways for other casual games to improve consumer spending. Only 3.7% of casual gamers in the U.S. make an IAP. However, that could be changing. Some ideas include “loot boxes,” bundle promotions, and boost items.

Cash In with AdAction as Your Partner

Increasing consumer spend in gaming apps is complex and competitive. These new data points shed light on the changing gamer and what motivates users to spend. With these insights and our takeaways, you can cash in on the trend. All you need is some support. Connect with our gaming app experts today.